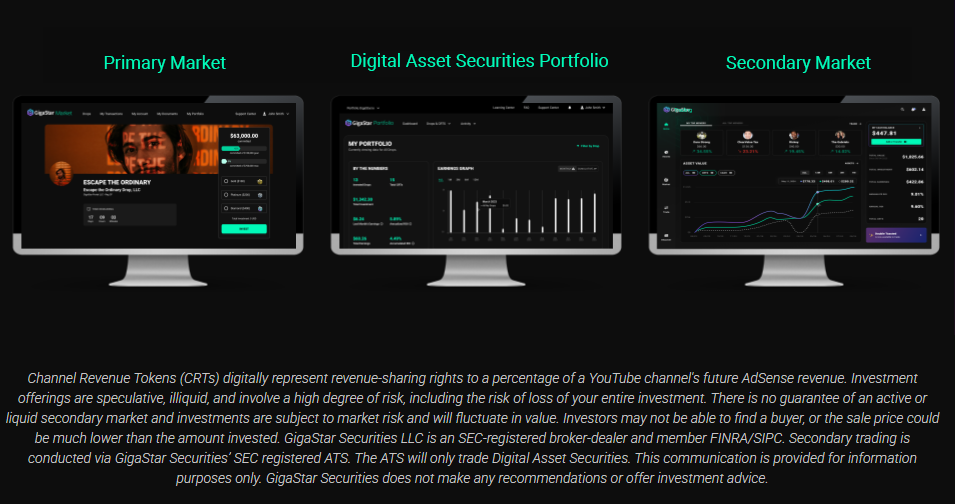

GigaStar’s secondary market may create liquidity by providing a Digital Assets Securities ATS platform where previously issued revenue share securities (revenue share units which make up Channel Revenue Tokens), can be bought and sold among investors. Key ways it fosters liquidity include:

1. Frequent Trading: Continuous buying and selling of securities allow investors to convert their assets into cash.

2. Potential Price Discovery: The potential high volume of transactions may help determine fair market prices, making it easier for investors to enter and exit positions.

3. Diverse Participants: The presence of a large number of buyers and sellers increases the chances of matching trades efficiently, promoting smoother transactions.

4. Transparency: Available price information and trade data help build trust and encourage participation, further enhancing liquidity.

By enabling efficient, transparent, and frequent trading, GigaStar’s secondary market works to ensure that assets remain easily tradable, thus enhancing market liquidity.